Vnice Power

Industry News

How to Calculate the ROI of a Commercial Solar Installation

19/4/2024

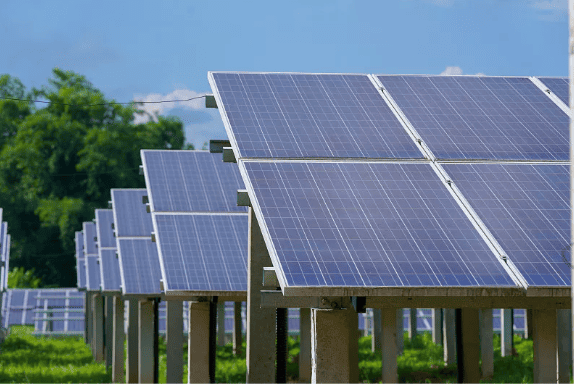

Commercial solar installations are becoming more and more common as companies look for methods to cut their carbon impact and save money on electricity.

However, it's crucial to ascertain the solar installation's return on investment (ROI) prior to making the expenditure. Understanding the implementation costs in detail as well as the potential benefits from lower energy costs and possible government subsidies are essential for calculating the ROI.

To help company owners decide whether or not to seek solar energy as a cost­saving measure, we will detail the steps involved in determining the ROI of a commercial solar system in this guide.

Understanding the Importance of ROI in Commercial Solar Installations

Return on investment, or ROI, is a key component in deciding whether business solar installations are financially feasible. In comparison to the original investment in a solar system, it calculates the amount of money produced or conserved. In other terms, return on investment (ROI) is a gauge of how profitable a solar venture is.

The fact that business solar setups are usually big and require a sizable initial investment highlights the significance of ROI. Business proprietors must determine whether the expenditure will be profitable in the long run given the high costs associated with implementation, upkeep, and operation. ROI enables them to assess whether the photovoltaic investment will generate a profit sufficient to cover the original outlay.

The ROI of business solar systems is impacted by a number of variables. These factors consist of the price of energy, the scale of the system, the standard of the apparatus, and the presence of incentives or rebates. When thinking about a solar venture, business proprietors must consider all of these aspects.

One of the most significant elements influencing the return on investment of commercial solar installations is the price of energy. The more savings a company can anticipate from solar power, the more expensive electricity is. Another important aspect of calculating ROI is system capacity. The system's capacity to produce energy increases with system size, increasing the possible savings.

ROI may also be impacted by the caliber of the solar system's equipment. Although high­quality machinery may initially cost more, it can produce more energy and be more dependable, which can increase profits over time.

The availability of incentives or rebates can also have a big impact on a photovoltaic venture's return on investment. To lower the original expenditure and boost ROI, business owners should take advantage of any tax credits, subsidies, or rebates that are accessible to them.

The financial feasibility of business solar systems is heavily influenced by ROI. When determining the return on investment (ROI) of a solar investment, business owners must take a number of variables into account, including the price of energy, the size of the system, the caliber of the equipment, and the availability of discounts or refunds.

Commercial solar systems can offer significant financial advantages and aid companies in lowering their ecological impact with careful planning and analysis.

Key Factors to Consider When Calculating ROI for Your Solar Installation

To evaluate the viability and financial advantages of a photovoltaic installation, determining the return on investment (ROI) is crucial. The ROI, which is usually stated as a proportion or ratio, assesses how profitable an investment is in comparison to its cost.

When determining the return on investment for your solar system, keep the following points in mind:

Initial Cost: When calculating the ROI, the initial cost of the solar installation—which includes the cost of the apparatus, personnel, licenses, and other costs—is an important consideration. The longer it takes to recover your money and achieve a return, the higher the original expense.

Electricity prices: Another important element in determining ROI is electricity prices. Higher energy costs make solar investments more valuable because they enable longer­term utility bill reductions that are higher.

Solar incentives: The ROI can be greatly impacted by solar benefits such as tax refunds, rebates, and net metering. These rewards can help lower the installation's original cost and boost the project's financial returns.

Energy Production: The quantity of energy the solar installation produces is a crucial element to take into account. Energy production that is higher translates into greater power bill savings and a more rapid return on investment.

Costs associated with maintenance and fixes: Although solar systems typically require little care, they occasionally may require repairs. The ROI estimate should take these expenses into account.

Options for Financing: The technique used to pay for the solar system may affect the ROI. Different financial consequences will result from options like leasing or outright buying the system, so they should be assessed appropriately.

Future Electricity prices: Lastly, when determining the ROI, it's critical to take future electricity prices into account. The worth of the solar expenditure rises and the ROI will be higher if rates are anticipated to rise.

In conclusion, contemplating a solar system requires careful consideration of the ROI. You can assess the project's viability and decide for yourself whether solar is the best option for you by taking into account the aforementioned considerations.

How to Calculate ROI for Your Commercial Solar Installation

When calculating the ROI (Return on Investment) of a business solar installation, it is important to take into account the installation's original cost, the savings the system produces, and the investment's payback time.

Here is how to determine the return on investment for your business solar installation:

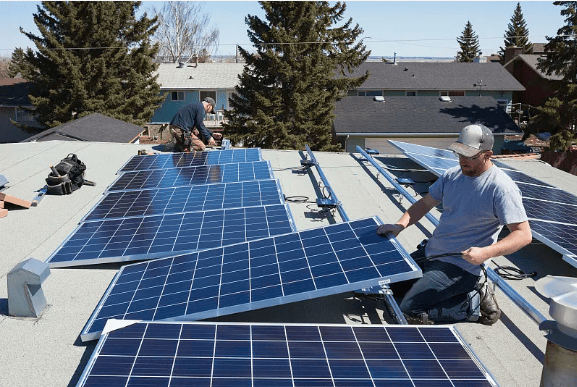

Calculate the cost of the installation, which includes the price of the solar panels, converters, mounting supplies, and labor. You might also need to budget for extra expenses like taxes, fees, and permission charges.

Reduced electricity costs represent the majority of the system's savings. The scale of the system and the quantity of energy it produces will determine how much money can be saved. This can be estimated by comparing the amount of energy your solar system is predicted to generate to your present electricity expenses.

The payback period is the length of time required for system savings to match implementation costs. Divide the implementation cost by the system's yearly savings to arrive at this figure.

ROI can be calculated by dividing the total savings produced by the system over the course of its lifespan by the implementation cost after you have established the payback period.

Consider a business commercial solar installation costs that costs INR 50 lakhs and produces INR 10 lakhs in annual savings. The five­year repayment term would apply. (INR 50 lakhs divided by INR 10 lakhs per year). The total savings made over the system's existence, assuming it has a 25­year lifespan, would be INR 2.00 crores. (INR 10 lakhs per year multiplied by 20 years).

This would result in a 300% ROI. (INR 2.00 crores divided by INR 50 lakhs).

It's essential to remember that depending on the location, size of the system, and other variables, the actual cost of the implementation, the savings realized, and the efficacy of the solar system may differ.

The Indian government also provides a number of rebates and benefits for solar installations, which can further lower the cost and boost ROI.

As a result, it's crucial to do your homework and speak with industry professionals to obtain precise quotes for your particular circumstance.

Interpreting Your ROI Results for Informed Decision Making

Return on investment, or ROI, is a crucial measure for any company wishing to evaluate the success of its financial choices. ROI is calculated as (Gain from Investment – Cost of Investment) / Cost of Investment, which is a straightforward calculation. Usually, the outcome is given as a proportion.

Making choices about prospective investments requires having accurate information, which can be difficult to interpret.

First, it's crucial to comprehend what a high or poor ROI actually implies. A high return on investment (ROI) indicates that the investment produced more profit than it cost, whereas a low ROI indicates that the investment did not produce enough profit to offset its cost.

Although a greater ROI is generally preferred, the target ROI will vary depending on the company's particular objectives and the sector it serves.

Additionally, it's critical to think about the environment in which the purchase was made. It might take longer to see a yield on an investment in a new product line than it would in a marketing effort, for instance.

Therefore, a poor short­term return on investment (ROI) does not inherently indicate that the investment was unsuccessful.

The length of time used to determine the ROI is a crucial element as well. A greater ROI may be achieved over a prolonged period of time, but this also indicates that the investment took longer to pay off. Therefore, when interpreting ROI findings, it is crucial to take into account the intended timeline for the investment's returns.

When making investment choices, it's crucial to take other metrics, such as internal rate of return (IRR) and net present value (NPV), into account in addition to the return on investment computation.

NPV gives a more accurate image of the investment's success over time because it considers the temporal worth of money. IRR determines how quickly an investment will yield profits and can be used to determine how risky an investment is.

Any outside influences on the success of the investment should be taken into account when analyzing ROI findings. Even if the expenditure was solid, a new competitor joining the market, for instance, could have affected sales.

As a consequence, when interpreting ROI findings, it is crucial to perform a comprehensive study of the external environment.

The opportunity expense of the expenditure should also be taken into account. This is the profit that might have been earned if the transaction had not been made. It is crucial to evaluate whether the expenditure was the best use of the available resources at the moment.

Making wise investment choices depends on being able to understand ROI outcomes. Understanding what a high or low ROI means is crucial, as is taking the investment's context into account and evaluating additional measures like NPV and IRR.

External variables and the investment's potential cost should also be taken into account. Businesses can improve their investment choices and foster long­term development and profitability by interpreting ROI findings holistically.

Conclusion: Why a Commercial Solar Installation is Worth Considering

For a number of factors, commercial solar systems are worthwhile. First, they can help you save a lot of money over the long run on your electricity expenses. A solar system can assist companies in lowering running costs and boosting revenue in light of the increasing cost of energy.

Additionally, as solar technology has become more affordable over time, a broader variety of businesses can now manage to implement solar power systems.

Second, business solar systems can support an organization's efforts in sustainability and CSR. Many partners and customers today are searching for companies that priorities sustainable business practices and environmental care.

Businesses can lessen their carbon impact and show that they are committed to sustainability by putting solar panels.

Third, installing business solar energy systems can act as a buffer against increasing energy prices. Businesses can profit from solar power's stability and predictability because it is less volatile and unpredictable than conventional energy costs.

Once a solar system is put in place, it can supply electricity at a set price, giving companies a feeling of security and steadiness.

Last but not least, business solar systems may qualify for sizeable tax breaks and rebates. Governments and utility companies frequently provide financial incentives to entice businesses to engage in renewable energy, which can increase the appeal of the original investment.

As a result, companies can enjoy a variety of financial, environmental, and social advantages from installing industrial solar systems.

They can boost sustainability initiatives, lower running costs, protect against increasing energy prices, and offer sizeable tax breaks and rebates

Commercial solar installations are becoming an increasingly appealing option for companies seeking to cut costs, boost profitability, and show their commitment to sustainability as the price of solar equipment continues to fall and energy prices rise.

WE OFFER BEST IN CLASS SERVICE FOR YOUR NEEDS

86-13631354535

-

Message